XTRD ICO Review — Unifying Cryptocurrency Exchanges

XTRD is comprised of a team of veteran Wall Street commerce

specialists with a mission to unify the cryptocurrency exchanges. This

mission has manifested in four product that ar all interconnected. These

product ar a unified FIX API almost like ones already used for prime

volume commerce, one purpose of Access (SPA) for cryptocurrency

exchanges to extend liquidity, a downloadable commerce platform to known

as XTRD professional, and a centralized Dark Pool for turning crypto

into enactment. With a safer and concrete infrastructure, entities

equivalent to banks, hedge funds, and enormous institutional traders

will simply access cryptocurrency markets

WHAT PROBLEM IS XTRADE (XTRD) SOLVING?

The following problems are associated with cryptocurrency trading:

A complex web of exchanges

A combination of differing KYC policies associated with APIs, funding, and interfaces will result in a fragmented patchwork of liquidity for the cryptocurrency. Major concerns for traditional cryptocurrency market participants range from liquidity and hacking prevention to unmitigated slippage and counterparty risks.

HIGH FEES

The exchange commissions associated with trading of cryptocurrencies typically are in 0.1%-0.25% range per transaction, which are 10 to 25 basis points. The effective fees of transactions are much higher when taken into spreads and bids maintained by the exchanges.

There is generally no central regulator or authority for examining internal exchange orders that systematically separates customer activity from proprietary activity, which can ensure fair pricing.

THIN LIQUIDITY

If not managed correctly and executed only on the exchange, a single order to purchase USD1,000,000 worth of cryptocurrency can cost an additional USD50,000-USD100,000 per transaction to the investors due to the lack of liquidity.

XTRADE offers the following solutions:

Three separate products in sequential stages will be launched by XTRADE to solve the problem of low per market liquidity, decentralized execution in cryptocurrency space, and unfamiliar interfaces.

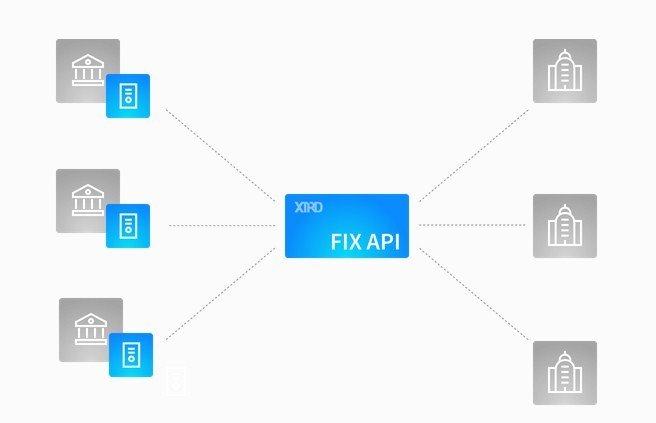

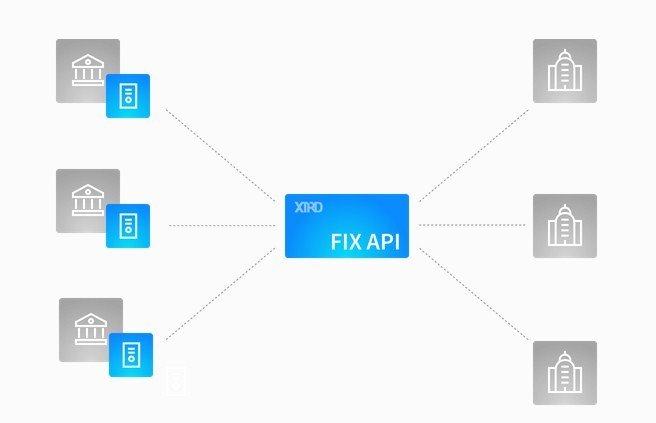

Stage 1. Implementation of the Multi Exchange Fix API

Xtrade will launch a universal low latency Financial Information eXchange (FIX) based API that will be connected to all cryptocurrency exchanges to make it easy for major algorithm traders, major institutions, and hedge funds to access all cryptocurrency markets by coding to just one FIX application.

Stage 2. Launching the XTRADE pro-trading platform

A highly robust, multi-exchange stand-alone trading platform will be launched by Xtrade in 2018 for active cryptocurrency traders around the world.

Stage 3. SPA (Single Point of Access) cross-exchange/liquidity aggregation

This platform will create a single unified point of access during stage 3 of development. It will aggregate liquidity across exchanges for cryptocurrency traders. In addition, it will allow traders to clear at the best possible price while systematically delivering the lowest possible transaction cost. It will also deliver atomic swap capability all within just one client-side account.

OFFICIAL YOUTUBE PRESENTATION

ABOUT XTRD

As of January 2018, there are over 120 standalone cryptocurrency exchanges, facilitating trading in more than 1000 individual markets. Daily trading volume for cryptocurrencies is now equivalent to 20 billion USD, with a total market cap of over $700 billion. The majority of the trading is concentrated among the top 20 exchanges, denominated in multiple currencies ranging from crypto ones including Bitcoin and Ethereum to sovereign ones such as USD, GBP, JPY, CNY, and KRW, among others. Predictions point to growth toward a $1–2 trillion market capitalization in 2018, and a corresponding 3% average daily trading volume of $50 billion or more. Asset managers are beginning to see increased demand for cryptocurrency exposure in their portfolios, over 500 active funds are being created to enter the market in 2018, and the regulatory climate is warming. However, the market is nascent, and large spreads are common between exchanges on the same crypto pairs, allowing for ample arbitrage opportunities that don’t exist in more efficient markets. The inefficiency is a product of cryptocurrency trading markets being highly fractured in terms of execution, account setup, automated access, liquidity, execution speed, pricing, and security. XTRD was created by finance and trading professionals to solve those problems by both improving on and consolidating current trading practices.WHAT PROBLEM IS XTRADE (XTRD) SOLVING?

The following problems are associated with cryptocurrency trading:

A complex web of exchanges

A combination of differing KYC policies associated with APIs, funding, and interfaces will result in a fragmented patchwork of liquidity for the cryptocurrency. Major concerns for traditional cryptocurrency market participants range from liquidity and hacking prevention to unmitigated slippage and counterparty risks.

HIGH FEES

The exchange commissions associated with trading of cryptocurrencies typically are in 0.1%-0.25% range per transaction, which are 10 to 25 basis points. The effective fees of transactions are much higher when taken into spreads and bids maintained by the exchanges.

There is generally no central regulator or authority for examining internal exchange orders that systematically separates customer activity from proprietary activity, which can ensure fair pricing.

THIN LIQUIDITY

If not managed correctly and executed only on the exchange, a single order to purchase USD1,000,000 worth of cryptocurrency can cost an additional USD50,000-USD100,000 per transaction to the investors due to the lack of liquidity.

XTRADE offers the following solutions:

Three separate products in sequential stages will be launched by XTRADE to solve the problem of low per market liquidity, decentralized execution in cryptocurrency space, and unfamiliar interfaces.

Stage 1. Implementation of the Multi Exchange Fix API

Xtrade will launch a universal low latency Financial Information eXchange (FIX) based API that will be connected to all cryptocurrency exchanges to make it easy for major algorithm traders, major institutions, and hedge funds to access all cryptocurrency markets by coding to just one FIX application.

Stage 2. Launching the XTRADE pro-trading platform

A highly robust, multi-exchange stand-alone trading platform will be launched by Xtrade in 2018 for active cryptocurrency traders around the world.

Stage 3. SPA (Single Point of Access) cross-exchange/liquidity aggregation

This platform will create a single unified point of access during stage 3 of development. It will aggregate liquidity across exchanges for cryptocurrency traders. In addition, it will allow traders to clear at the best possible price while systematically delivering the lowest possible transaction cost. It will also deliver atomic swap capability all within just one client-side account.

WHY IS XTRADE (XTRD) A GOOD PROJECT ?

This platform wants to it simple for investors to effectively interact with cryptocurrency markets.

Price transparency: It will aggregate prices from all exchanges in real-time. It means that if any cryptocurrency is trading at a discount half across the world, cryptocurrency will know.

Lower execution cost: This platform will be able to access lower trading fee tiers by trading at high volume across exchanges and aggregated trades. It will then pass the saving onto clients.

More liquidity: This platform will allow cryptocurrency investors and traders to instantly access liquidity. It will allow for improved arbitrage opportunities, higher execution quality, and better price.

Reduced counterparty risk: This platform gives traders the benefits of worldwide price liquidity and improvement without the counterparty risk.

Reduce Slippage: The liquidity pool aggregation and smart routing tools break into smaller pieces for ensuring that slippage is a non-issue.

Multiple Markets with One Account: This platform allows investors and traders for trading multiple markets with a single account with no need to open separate accounts at different exchanges and systematically track price manually.

It will be used as a primary means of payment by users for obtaining services rendered by this platform.

XTRD tokens will be sold by this platform to accredited investors through a SAFT (simple agreement for future tokens).

The price of one token will be USD0.10 during the ICO sale.

Price transparency: It will aggregate prices from all exchanges in real-time. It means that if any cryptocurrency is trading at a discount half across the world, cryptocurrency will know.

Lower execution cost: This platform will be able to access lower trading fee tiers by trading at high volume across exchanges and aggregated trades. It will then pass the saving onto clients.

More liquidity: This platform will allow cryptocurrency investors and traders to instantly access liquidity. It will allow for improved arbitrage opportunities, higher execution quality, and better price.

Reduced counterparty risk: This platform gives traders the benefits of worldwide price liquidity and improvement without the counterparty risk.

Reduce Slippage: The liquidity pool aggregation and smart routing tools break into smaller pieces for ensuring that slippage is a non-issue.

Multiple Markets with One Account: This platform allows investors and traders for trading multiple markets with a single account with no need to open separate accounts at different exchanges and systematically track price manually.

TOKEN PRICE AND TOKEN SALE

XTRD token is an ERC20 compliant utility token, which is developed on the Ethereum blockchain just like other popular ICO tokens such as BunnyToken, Cibus, Amon, Aktie Social, Alttex, THEFANDOME.It will be used as a primary means of payment by users for obtaining services rendered by this platform.

XTRD tokens will be sold by this platform to accredited investors through a SAFT (simple agreement for future tokens).

The price of one token will be USD0.10 during the ICO sale.

USE OF XTRD FUNDS

70% of the funds will be used for SPA development.

5% will be used for tech acquisition.

5% will be used for sales and marketing.

5% will be used for legal and compliance purposes.

15% of the funds will be used for platform developments and operations.

ALLOCATION OF TOKENS

50% of XTRD tokens will be issued for sale during the ICO event.

29% will be held in reserve.

10% XTRD tokens will be allocated as an advisor pool.

10% XTRD tokens will be allocated to a team.

1% tokens will be allocated for bounty rewards.

PARTNERS

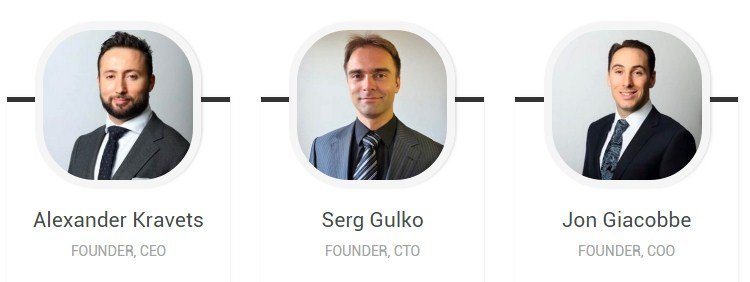

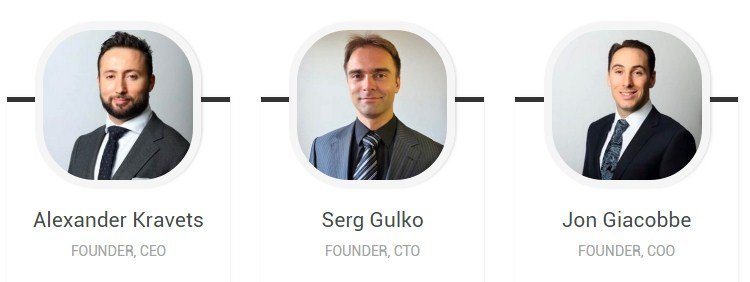

XTRD TEAM

No comments